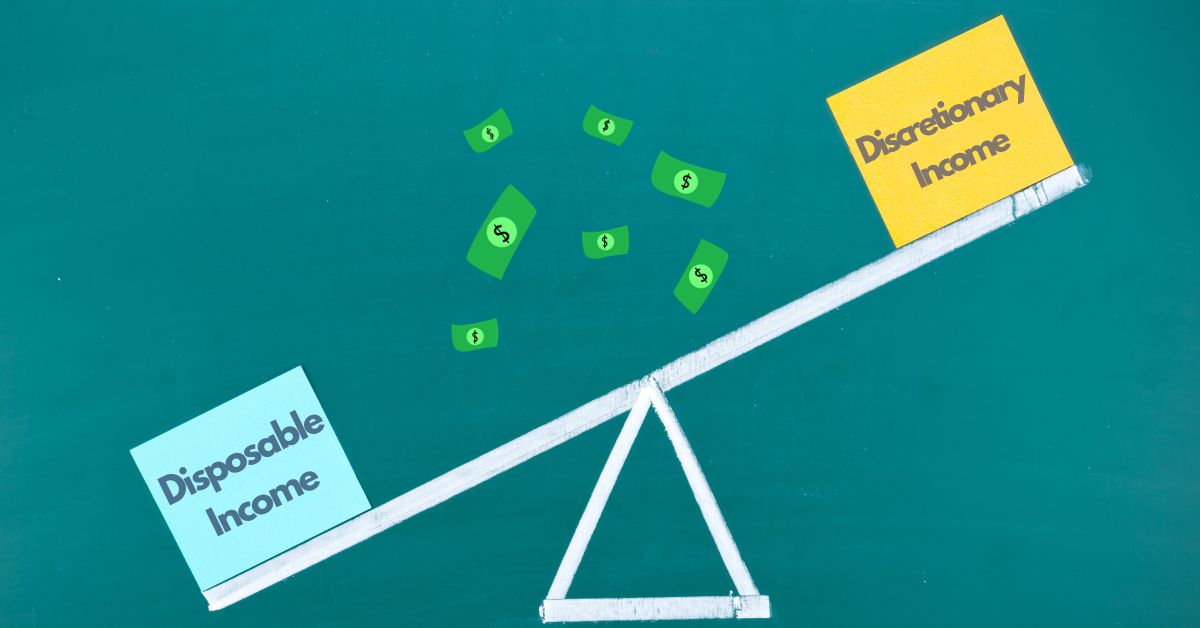

Have you ever wondered why some people seem to effortlessly achieve their financial goals while others struggle to make ends meet? The secret lies in how they manage their income. Understanding the two key concepts- disposable and discretionary income can make all the difference in your financial well-being.

You receive your paycheck, and it’s more than just numbers on a piece of paper. It’s the means to fund your dreams, secure your future, and create the life you desire. But how do you make the most of it? That’s where the concepts of disposable and discretionary income come into play.

What is Disposable Income?

In simple terms, it’s the money you have at your disposal after various obligations have taken their share. Think of it as the financial foundation on which you build your life, make decisions, and strive for your financial goals.

Your disposable income is not a fixed number but rather a dynamic figure that evolves with your financial circumstances. It represents the income you have left once the mandatory deductions, such as taxes and other obligations, have been accounted for. This is the amount you can allocate towards your needs, wants, savings, and investments. It’s the part of your paycheck that empowers you to take control of your financial destiny.

Calculation of Disposable Income

To gain a clearer understanding of disposable income, let’s delve into its calculation. This process involves several components, and comprehending how they come together is essential for effective financial planning.

- Gross Income: The starting point is your gross income, which is the total amount you earn before any deductions. This includes your salary, wages, bonuses, and any other sources of income.

- Taxes and Deductions: Next comes the subtraction of various taxes and deductions. These may include federal and state income taxes, Social Security contributions, Medicare deductions, and any other mandatory withholdings as per your country’s tax laws.

- Voluntary Deductions: Additionally, you may have voluntary deductions, such as contributions to retirement accounts, healthcare premiums, and other benefits. While these reduce your take-home pay, they can offer long-term financial advantages.

- Disposable Income Calculation: Once all deductions are accounted for, you arrive at your disposable income. This is the amount available for immediate expenses, savings, investments, and discretionary spending.

Disposable Income = Gross Income – Taxes and Deductions – Voluntary Deductions

What is Discretionary Income?

In essence, discretionary income is the money you have at your disposal after covering all your essential expenses and financial obligations. It’s the part of your income that’s not earmarked for fixed costs like housing, food, and utilities. Instead, it’s your financial canvas, allowing you to paint a picture of the life you aspire to lead.

While disposable income forms the foundation of your financial stability, discretionary income represents the next level, a space where you can exercise discretion and allocate funds based on your individual preferences and goals. It’s the portion of your paycheck that can be directed towards enhancing your quality of life, pursuing hobbies, indulging in leisure activities, or investing in personal growth.

Calculating Discretionary Income

Understanding how to calculate discretionary income is vital for making the most of this financial freedom. It involves a straightforward yet essential process that empowers you to take charge of your financial decisions.

To calculate discretionary income, follow these steps:

- Determine Disposable Income: Start by identifying your disposable income, which we discussed earlier. This is the amount left after all mandatory deductions and fixed expenses have been accounted for.

- Identify Fixed Expenses: Next, subtract your fixed expenses from your disposable income. These include essential costs like housing, food, clothing, utilities, and other non-negotiable needs. The resulting figure represents your discretionary income.

- Allocate Discretionary Income: With your discretionary income in hand, you can now strategically allocate it based on your preferences and financial goals. This is where you decide how much to save, invest, spend on leisure activities, or channel into personal development.

Discretionary Income = Disposable Income – Fixed Expenses

15 Ways to Balance Them

In the journey of personal finance, achieving a harmonious balance between your necessities and your discretionary spending can be akin to finding the sweet spot on a financial spectrum. To master this art, we must first understand the roles that “needs” and “spending” play in our financial stability.

Needs, often referred to as fixed expenses, are the non-negotiable financial obligations that form the backbone of our financial lives. They encompass critical elements like housing, food, clothing, and utilities. These expenses are the cornerstone of our financial stability and must be met consistently.

On the flip side, we have discretionary spending, which represents the allocation of discretionary income for wants and non-essential spending. It’s the part of your income that grants you the freedom to pursue your desires and interests, whether it’s dining out, entertainment, or hobbies. So, how do we strike a balance between these two facets of our financial world? It begins with a conscious assessment of our needs and an understanding of our discretionary income’s potential. Here are some practical steps to guide you on this journey:

- Calculate Your Baseline

Start by meticulously calculating your baseline expenses, which encompass your essential living costs. This includes housing (rent or mortgage payments), utilities (electricity, water, gas), groceries, transportation (commuting costs or car payments), and debt payments (credit cards, loans, or any outstanding debts). This foundational step sets the stage for understanding your financial obligations and necessities. - Determine Your Savings Goals

Begin by setting clear savings objectives, differentiating between short-term goals (such as building an emergency fund or planning a vacation) and long-term ambitions (like saving for retirement or buying your dream home). Knowing what you’re saving for not only gives you a sense of purpose but also allows you to allocate your discretionary spending with these objectives in mind. - Automate Savings and Debt Payments

Take advantage of automation by scheduling regular transfers to your savings account and for debt payments. This smart financial move ensures that you’re consistently setting aside funds for both savings and debt reduction before even contemplating discretionary expenditures. It’s an effective way to prevent financial stress and prioritize your financial well-being. - Create a Discretionary Spending Plan

Establish a well-defined monthly budget specifically for discretionary spending categories, such as entertainment, dining out, hobbies, and leisure activities. Make sure to be realistic about your discretionary budget, considering your income and financial goals. Practice reverse budgeting which acts as your guide, allowing you to indulge responsibly without jeopardizing your long-term financial objectives. - Track Every Expense

Keep a meticulous record of every single expense, including discretionary ones. Employ budgeting apps like Mint or spreadsheets to gain insight into where your money is flowing. This practice not only helps you understand your spending patterns but also empowers you to identify areas where you can potentially cut back, embrace frugal living, or make more informed choices. - Implement the 50/30/20 Rule

Adhere to the well-regarded 50/30/20 rule, allocating 50% of your after-tax income to essential expenses, 30% to discretionary spending, and 20% towards savings and debt repayment. However, remember that these percentages can be adjusted according to your unique financial circumstances and goals. Flexibility is key in personal finance. - Prioritize High-Value Spending

Focus your discretionary spending on experiences and items that genuinely bring you joy and align with your core values. Trim down expenses that don’t significantly enhance your life. This discerning approach ensures that your discretionary spending enriches your life rather than merely draining your wallet. - Use Cash or Prepaid Cards

Consider adopting cash or prepaid cards for your discretionary spending categories. By utilizing these tangible forms of payment, you set clear spending limits. When the cash runs out or the card balance depletes, it serves as a built-in budgetary control, encouraging you to stick to your financial plan. - Practice Delayed Gratification

Institute a “cooling-off” period for significant discretionary acquisitions. Before making a substantial purchase, wait 24 to 48 hours. This pause allows you to assess whether it’s a genuine need or simply a fleeting desire, helping you make more prudent financial decisions. - Regularly Review and Adjust

Incorporate routine budget reviews, whether on a monthly or quarterly basis. During these assessments, evaluate your progress toward your savings objectives and make necessary adjustments to your discretionary spending based on your evolving financial priorities. - Boost Your Income

Don’t limit your financial growth solely to expense management. Investigate opportunities to augment your income, such as engaging in side gigs, freelancing, or making wise investments in appreciating assets. A higher income provides more flexibility for your discretionary spending while also contributing to your overall financial well-being. - Emergency Fund for Unplanned Expenses

Maintain a dedicated emergency fund to cover unforeseen and unplanned expenses. By having this financial safety net, you reduce the likelihood of tapping into your discretionary budget in case of emergencies, thus preserving your financial stability. - Limit Credit Card Use

Restrict your reliance on credit cards for discretionary spending. Excessive credit card usage can lead to high-interest debt accumulation. Aim to pay off your credit card balances in full each month to avoid costly interest charges, which can eat into your discretionary income. - Educate Yourself Continuously

Dedicate time to continuous financial education. Expand your knowledge about investing, explore advanced budgeting techniques, and discover strategies to make your money work harder for you. The more informed you are, the better equipped you’ll be to manage your financial resources effectively. - Celebrate Milestones

Recognize and celebrate your financial milestones and achievements, no matter how small or significant. Whether it’s paying off a debt, reaching a savings milestone, or consistently adhering to your budget, positive reinforcement can serve as motivation to stay committed to your financial goals and maintain your financial equilibrium.

Final thoughts

Effective income management is not just a financial strategy; it’s a life skill that empowers you to create the future you envision. By understanding the differences between these two income categories and learning to balance your needs and wants, you can make informed financial decisions that lead to prosperity. As you navigate your financial journey, remember that knowledge is your greatest asset. Keep exploring, keep learning, and keep making choices that align with your financial goals. By doing so, you’ll unlock the doors to financial freedom and set a course for a brighter, more secure future.