After a blockbuster run for U.S. equities in the first half of 2025, investors are beginning to ask: what’s next? As the S&P 500 flirts with all-time highs and economic data sends mixed signals, many portfolio managers are turning their attention to commodities. This shift in capital allocation is known as cross-asset rotation – and in 2025, it may be one of the most important trends to watch. This article explores why commodities like oil, copper, and gold may be poised to outperform U.S. stocks in the months ahead.

What Is Cross-Asset Rotation? And Why It Matters Now

Cross-asset rotation refers to the movement of capital between different asset classes, such as equities, commodities, bonds, and cash. Investors rotate assets to capture returns in sectors likely to outperform under changing macroeconomic conditions. Historically, such rotations intensify during inflection points – shifts in interest rates, inflation trends, or geopolitical dynamics.

This strategy is not just used by institutional investors. Increasingly, retail traders are leveraging ETFs and robo-advisors that automate allocation shifts based on these macro signals. The appeal lies in diversification and adaptability – investors can reduce drawdowns by reallocating capital when warning signs appear in overheated markets.

In the context of 2025, the Federal Reserve’s policy pivot, a weakening U.S. dollar, and cooling equity momentum all signal a potential shift toward hard assets.

2025 Market Context: Why U.S. Equities May Be Peaking

While equities have delivered strong year-to-date returns, several headwinds loom:

- Valuation concerns: The S&P 500 trades at a forward P/E ratio significantly above historical norms, driven primarily by a handful of mega-cap tech stocks. This concentration risk has amplified volatility.

- Monetary uncertainty: Although the Fed is signaling potential rate cuts, inflation remains sticky due to persistent wage growth and global commodity pressures. A delayed or slower rate-cut cycle could disappoint equity markets.

- Geopolitical tensions: Conflicts in the Middle East, tensions in the Taiwan Strait, and ongoing trade frictions with China have introduced a new layer of risk premium into equity markets.

- Earnings divergence: Not all sectors are thriving. While AI and semiconductors have outperformed, consumer discretionary and small caps are lagging, creating an uneven rally.

Taken together, these factors create an environment where risk-adjusted returns from equities may diminish – opening the door for alternative assets to shine.

Why Commodities Are Poised to Shine in 2025

Commodities tend to outperform in late-cycle economic environments, especially when inflation is elevated or the dollar is weakening. Several drivers are aligning in 2025:

- Dollar weakness: The U.S. dollar index (DXY) has declined 8% since January, boosting commodity prices denominated in dollars and increasing foreign demand.

- Demand revival: Industrial metals are surging on infrastructure spending in Asia and Europe. China’s post-COVID recovery has reignited demand for steel, copper, and rare earths.

- Energy constraints: Years of underinvestment in fossil fuel infrastructure are now colliding with resurgent demand. Oil prices remain elevated due to OPEC+ production caps, geopolitical disruptions, and weather-related issues.

- Safe-haven appeal: Gold and silver are regaining popularity amid central bank diversification away from the dollar and concerns over mounting U.S. debt levels. Central banks, particularly in emerging markets, are increasing their gold reserves as a hedge against currency volatility.

- Green transition: Commodities critical to clean energy – lithium, nickel, cobalt – are benefiting from accelerating EV adoption and renewable energy expansion.

Commodity Sectors to Watch

- Energy: Oil (WTI, Brent), Natural Gas – High volatility but strong upside in the face of supply shocks and geopolitical risks.

- Precious Metals: Gold, Silver – Historically inversely correlated to real interest rates and U.S. dollar strength.

- Industrial Metals: Copper, Lithium – Infrastructure-driven demand and supply bottlenecks could create price spikes.

- Agriculture: Wheat, Soybeans – Climate-related disruptions and export restrictions are affecting global supply chains.

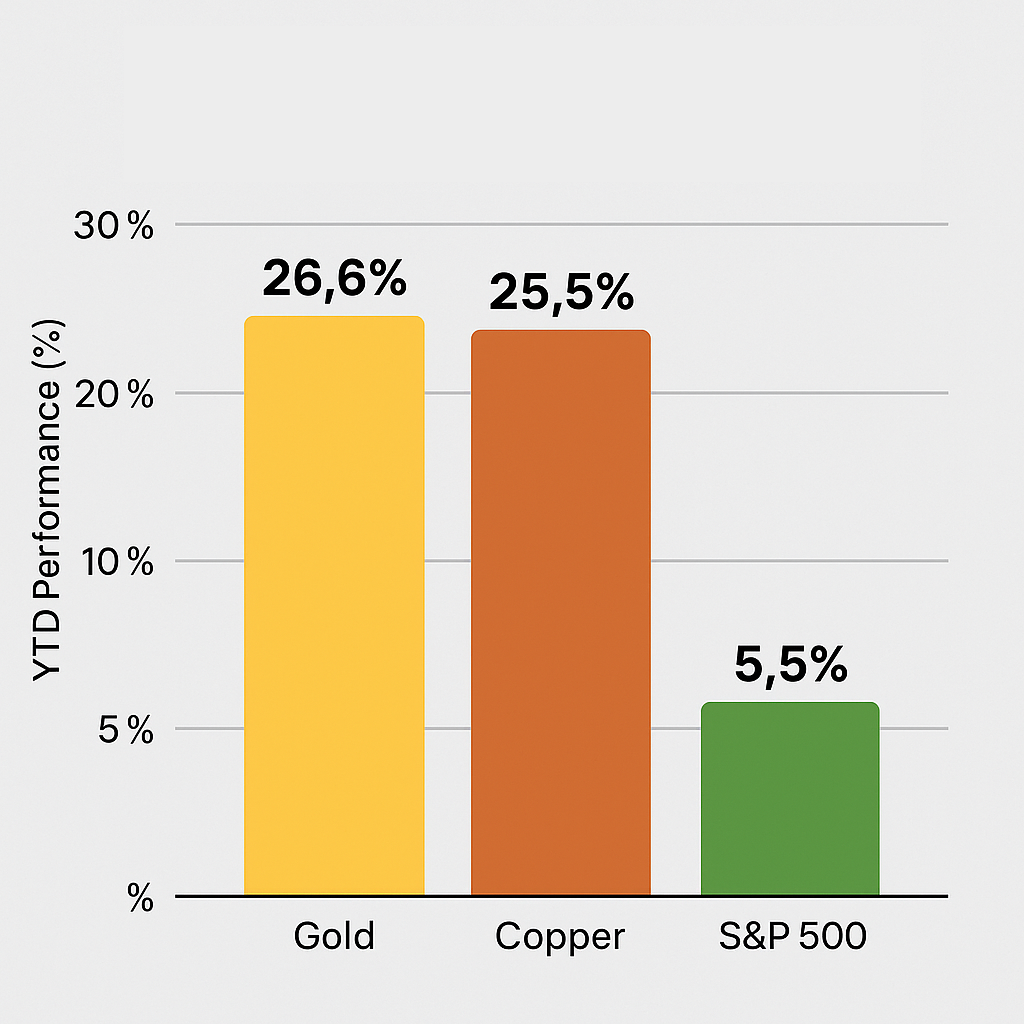

Data Speaks: Performance Trends in Cross-Asset Markets

Let’s look at the numbers (approx. YTD June 2025 values):

- Gold : +26% YTD

- Copper : +25% YTD

- S&P 500 : +5.5% YTD

Not only are commodities outpacing U.S. equities in 2025, but volatility-adjusted returns (Sharpe ratio) also favor commodities. Moreover, fund flows indicate a growing institutional appetite.

Retail investor interest is also on the rise, with Google Trends showing a surge in searches for “how to invest in commodities” and “gold ETF 2025.”

Risks to the Commodity Bull Case

No investment is without risks and its disadvantages. Key challenges include:

- Disinflation: If inflation drops sharply due to technological deflation, supply chain normalization, or global slowdown, commodity demand may ease.

- Economic slowdown: A global recession – particularly in China or the EU – would reduce demand for industrial metals and energy products.

- Policy intervention: Strategic petroleum reserve releases, price controls, or tariffs could distort market signals.

- Geopolitical resolution: De-escalation in conflict zones may lead to a drop in risk premiums embedded in commodity prices.

- Speculative excess: A rapid influx of speculative capital can inflate prices unsustainably, leading to sharp corrections.

How to Position for a Rotation

Retail and institutional investors alike should consider:

- Diversified exposure: Use broad-based commodity ETFs like GSG or diversified mutual funds to avoid overconcentration risk.

- Tactical allocation: Strategic allocation to commodities can act as a hedge against equity drawdowns and inflation.

- Dollar-cost averaging: Gradual entry helps manage volatility and avoids mistiming market peaks.

- Thematic investments: Consider targeted exposure to clean energy metals (e.g., LIT ETF) or agriculture funds.

- Gold as insurance: Allocate 5–10% to gold as a long-term store of value, particularly useful during financial system stress or geopolitical upheaval.

Conclusion

Cross-asset rotation is not just a technical term – it reflects real shifts in how investors perceive risk and opportunity. With U.S. equities looking stretched and inflation staying stubborn, 2025 could be the year commodities reclaim center stage. Investors who understand the macro forces at play and adjust their allocations proactively may benefit from improved diversification and risk-adjusted returns.

In an increasingly complex market landscape, staying ahead of capital flows across asset classes is not just smart – it’s essential.